Amendments in the tax audit form in Form 3CD

Amendments in the tax audit form in Form 3CD

- New Revision of Income-tax audit report in form 3CD in certain cases

- Changes in Income tax audit Clause 32 to report adjustment is brought forward of losses if option Under Section 115BAC/115BAD is exercised

- Modification to Income tax audit Clause 8a to include the exercise of option U/s 115BAC/115BAD

- Omission of Income-tax audit Clause 36 (DDT)

- Amendment in Income tax audit Clause 17 to Report higher safe harbor rule of 20 percentage between actual sales consideration & stamp duty value U/s 43CA and 56(2)(x)

- Changes in Income tax audit Clause 18 related to Adjustment in WDV of Assets Adjustment made to the written down value U/s 115BAD (for AY 2021-22 only)

What are the general Errors in Form 3CD TAX AUDIT U/S-44AB ?

General Errors in Form 3CD – Section 44AB of the Income Tax Act of 1961 (TAX AUDIT U/S-44AB of the Income Tax Act of 1961)

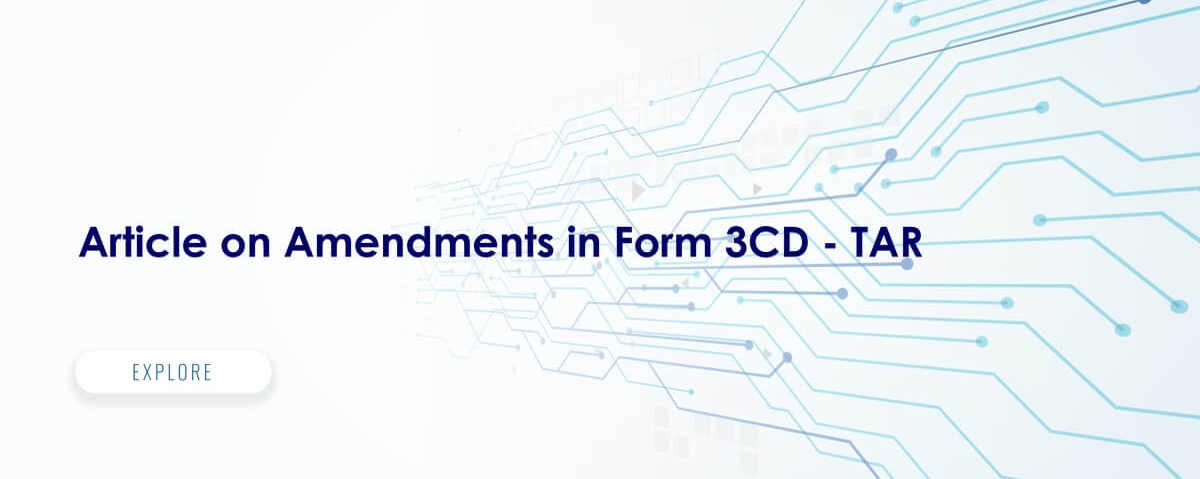

Legislation Under section-44AB for Financial Year 2021-22

- Sales, marketing, and other aspects of business > 1,00,00,000 and 10,00,00,000 rupees

- Profession:-Gross Revenue, etc. 50,00,000 rupees

- Business: Under section -44AE/BB/BBB, Income

- Profession: Under section -44ADA, Income Limited to Basic Exemptions

- Business: Under section -44AD, Income 8% /6 % Plus TI >Limited to Basic Exemptions

3CA & 3CD (Forms 3CA & 3CD)

Anyone who is subject to a tax audit must provide the following information to the IRS when submitting an income tax return:

- Audit Form (Form 3CA)

- Form 3CD – Statement containing pertinent information

6G Rule: Prescribe the form for the audit report. U/s-44AB

- Form-3CA- If any other law requires an audit, report it.

- And Form-3CB- Reporting in Other Situations

- Form-3CD- Report-Form-3CA/3CB Annexure

Section-271B

- Since U/s-44AB, there is a penalty for failing to get audited.

- Choose the lowest of the following options: – 5% of all sales/turnover/gross receipts, or Rupess. 150,000

Form-3CA & 3CB for qualification of Para observation:

- Many Tax audit reports do not include the “Assessee obligations” and “Tax auditors responsibilities” as required by the Guidance note on SA 700.

- It was also noted that Qualification Para Certain TAR refers to Form-3CD, which is not a qualification but rather general supplementary information.

Form-3CD, Provision (8): Indicate the appropriate section 44AB clause under which the audit was performed.

Clause(a) of 44AB

Section 44AB Clause(b)

Clause(c) of 44AB

Section 44AB Clause(d)

Clause(e) of 44AB

3rd Proviso to 44AB: Audit under any other Law

3rd Proviso to 44AB:

In the event that such person is required by or under any other law to have his accounts audited, it shall be sufficient compliance with the provisions of this section if such person has the accounts of such business or profession audited under such law before the specified date and furnishes the audit report as required under such other law by that date.

Observation: Tax Audit reports for “Companies/LLP” that are required to be audited under the Companies Act 2013 and the LLP Act 2008, respectively, pick clause (a) instead of option 3rd Proviso to 44AB.

Form-3CD Clause (2): Address

Observation: –

- It has been discovered that several TAR addresses in Form-3CA/3CB do not match those supplied in “Annual Reports to MCA.”

- According to the GN, the TAR shall contain the assessee’s address as of the date of signing of the A.R. for assessment purposes.

Clause-11(a) of Form-3CD: Whether or not books of account (BOA) are required under section 44AA, and if so, what books are required.

Observation:

- Under section-44AA Only Specified professionals are required to keep books of account.

- There are no business books recommended.

- In addition, the Companies Act of 2013 does not provide any BOA for corporations.

- As a result, in terms of BUSINESS, TAR should have “No” in this sub-clause.

List of books of account and kind of essential papers reviewed (clause-11(c) of Form-3CD).

Observation:

- It has been noted that tax auditors do not give references for all essential papers reviewed, such as invoices, bills, client certificates, confirmations, and so on.

- Please include it because it is a requirement of the Guidance Note.

Section 23 of the Micro, Small and Medium Enterprises Development Act of 2006 makes the amount of interest inadmissible.

Observation:

Interest paid to MSME is recorded in the Annual Report but is not disclosed in the TAR.

Clause 34(a) of Form-3CD: If the assessee is obliged to deduct or collect tax under the requirements of Chapter XVII-B or Chapter XVII-BB, please include the following information.

Observation:

Total Expenses in TAR, such as salary, rent, professional fees, and commission, do not match the amounts in the Audited F.S.

The following are some of the most typical tax audit mistakes made by Chartered Accountants while submitting tax audits:

- GST Interest, Late Fees, and Penalties:

There are two points of view on whether interest, late fees, and penalties should be allowed under GST:

- Penalties, fees, and fines are not allowed to be deducted from turnover for calculating profit under section 37 of the Income Tax Act of 1961. Section 37 prohibits the use of funds for any purpose that is illegal or forbidden by law.

- One viewpoint is that interest, late fees, and penalties are not allowed under GST;

- Another viewpoint is that Interest and Late Fees are allowed as a charge against late GST payment. Under an income tax, the same is permissible. Section 37, on the other hand, prohibits the imposition of a GST penalty.

CAS should, in their opinion, account for these expenditures when preparing tax audit reports.

Observing Section 145A of the 1961 Income Tax Act

Section 145A. For the purpose of calculating the income chargeable under the head “Profits and gains of business or profession,”—

(ii) the valuation of purchases and sales of goods or services, as well as inventory, shall be adjusted to include the amount of any tax, duty, cess, or fee (by whatever name called) actually paid or incurred by the assessee to bring the goods or services to the place of Location.

Discussions:

- As per Section 145A, the amount of any tax, duty, cess, or fee shall be included in the valuation of sale when calculating inventory valuation for the sale of goods.

- CA should verify that when performing stock valuation, the value of inventory includes the amount of any tax, duty, cess, or fees. The cost must include the amount of taxes on the items. Goods and Service taxes were among the taxes imposed.

The TDS credit in the books should correspond to which TDS as per AS 26.

- Check the receipts and TDS in 26AS against the receipts and TDS in the books of accounts. In ITR, the same should be shown.

- If there is a discrepancy between the information provided in the ITR and the information provided in the 26AS, a notification may be issued.

- Chartered Accountants should be aware of section 14A of the Income Tax Act of 1961, which allows for the disallowance of costs incurred in obtaining tax-exempt income in conjunction with Rule 6D.

- The GST Return Return should match the Turnover in the Books.

- Failure to comply with or report ICDS would be considered professional negligence and will be subject to a penalty under Section 271J.

- Interest paid to an NBFC is subject to TDS and is not exempt like interest paid to a bank. Needless to say, putting it in the TAR on the spur of the moment will have negative repercussions.

- Section 269SS and 269T reporting will include the acceptance and repayment of NBFC loans.

This is not a complete list. These are some of the main precautions you should take to avoid CA being subjected to a tax audit penalty.

Tax Audit Penalty of INR 10k on CA’s for Error in the Tax Audit Report

This article outlines the penalties that can be imposed on Chartered Accountants for providing inaccurate reports.

- An Assessing Officer can assess a penalty of Rs. 10,000 on a Chartered Accountant under Section 271J of the Income Tax Act, 1961,

- If the Assessing Officer considers the CA has provided inaccurate information in his report.

Popular Articles related to Tax Audit :

- Amendment in Tax Audit u/s 44AB

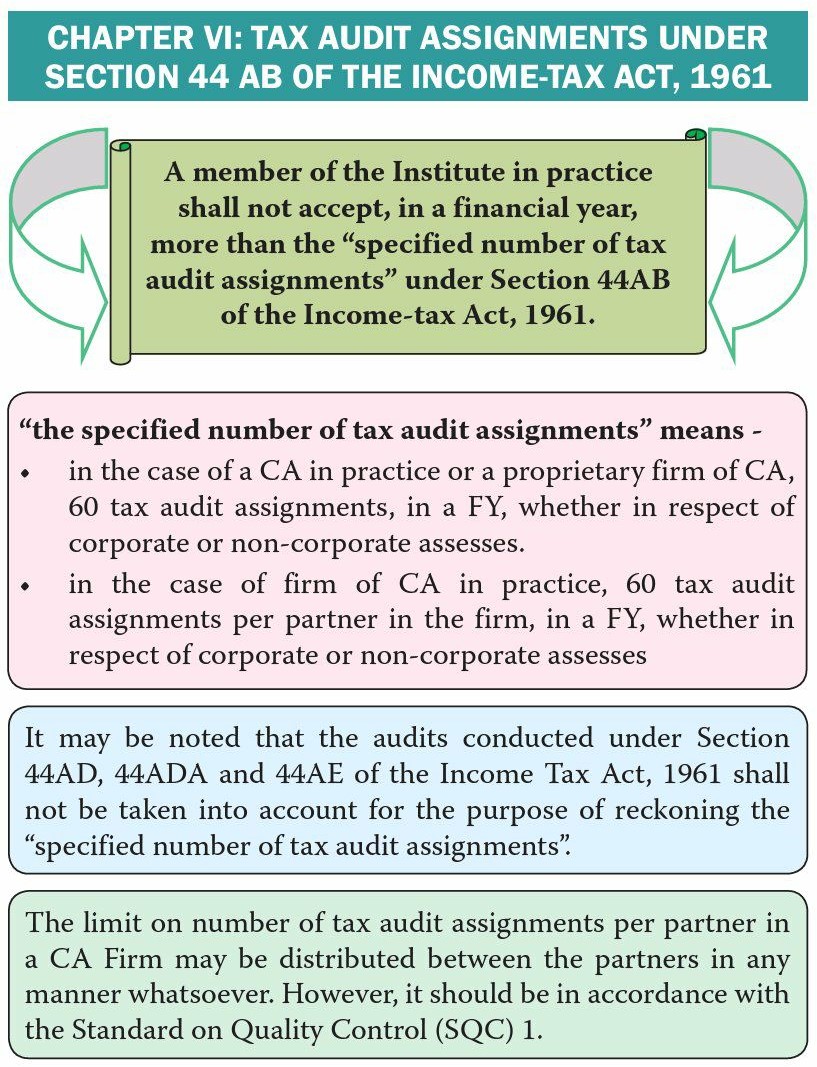

- Limit Applicable for tax Audit U/S 44 AB under Income Tax

- Tax Audit Check List

- Tax Audit Updated 01.08.2022 Under the Income Tax Act